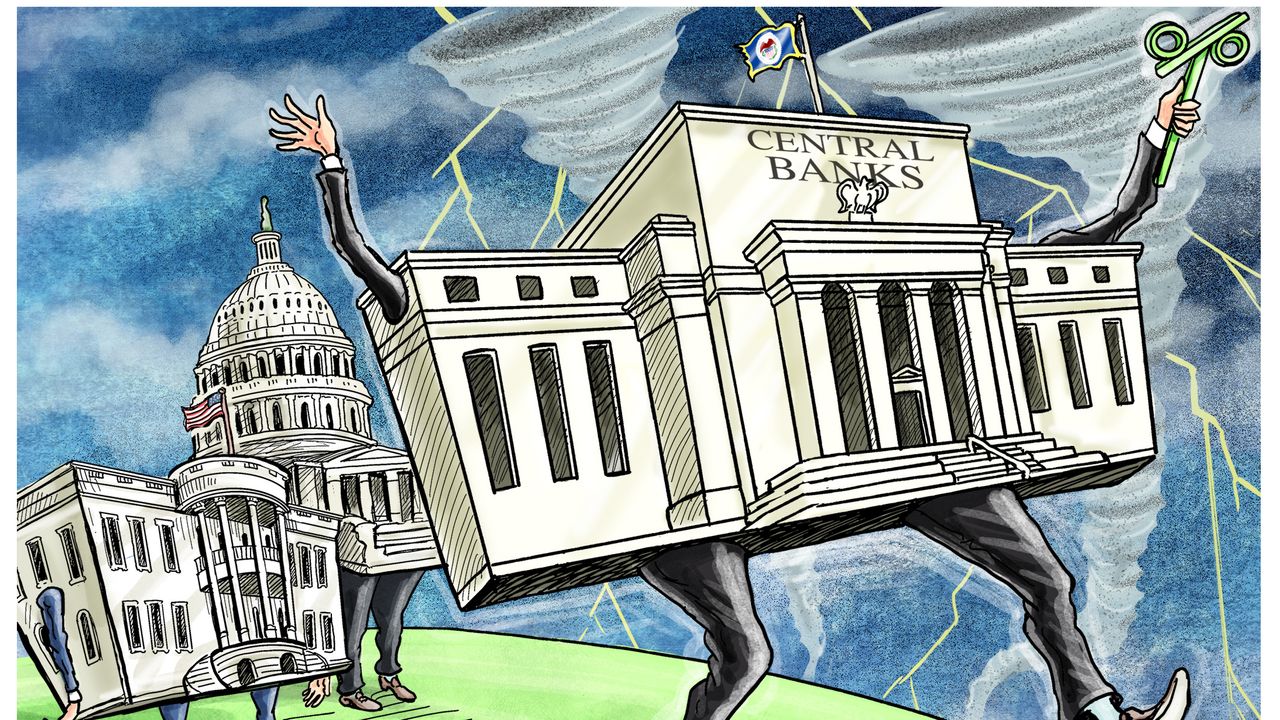

Central banks play a crucial role in shaping economic landscapes and influencing market behavior. Their decisions can lead to significant fluctuations in stock prices, interest rates, and overall market stability. In this article, we will explore the current state of central banks, particularly focusing on the Bank of Japan, and how their actions impact traders and investors alike. We will also look into recent market trends, volatility, and the implications for future investments.

The Role of Central Banks in Market Stability

Central banks are responsible for managing a nation’s currency, money supply, and interest rates. Their primary objective is to ensure economic stability and growth. However, their interventions can sometimes lead to unintended consequences.

- Regulate monetary policy

- Control inflation rates

- Stabilize the currency

- Manage employment levels

- Support financial institutions

In recent times, we have witnessed the Bank of Japan’s strategies to stabilize its economy, particularly in the face of market volatility. The central bank’s decisions can create ripples across global markets, affecting everything from commodities to cryptocurrencies.

The Current State of Central Banks: A Focus on the Bank of Japan

Such a stance raises questions about the effectiveness of central banks in managing economic crises. As traders and investors, understanding these dynamics is essential for making informed decisions.

Market Volatility: Historical Context and Recent Trends

Market volatility has been a significant theme in recent months, with fluctuations reminiscent of past economic crises. For instance, the volatility index (VIX) has seen spikes that correlate with historical events like the Lehman Brothers collapse and the Greek crisis.

When volatility reaches such heights, it often signals capitulation within the markets. This can lead to temporary lows, which may present buying opportunities for savvy investors.

Analyzing Recent Market Behavior

Recent data indicates that after periods of extreme volatility, markets tend to rebound. For example, the S&P 500 has historically shown positive forward guidance following significant VIX spikes. This could suggest a potential bottoming out, providing a window for investment.

Moreover, the equity risk premium has ticked up for the first time since 2023, indicating a shift towards equity purchases as investors seek growth opportunities amidst uncertainty.

Impact of Central Bank Decisions on Market Sentiment

Central banks’ decisions directly influence market sentiment. For instance, the anticipation of rate cuts can lead to bullish behavior among traders, while unexpected rate hikes may cause panic selling.

Currently, there is speculation about upcoming rate cuts, with varying expectations of their magnitude. This uncertainty creates a volatile trading environment, as market participants adjust their strategies based on central bank signals.

The Role of Hedge Funds and Institutional Investors

Hedge funds and institutional investors play a pivotal role in market dynamics. Their actions can exacerbate volatility, especially during periods of uncertainty. Recently, hedge funds have been observed buying aggressively, signaling confidence in certain sectors despite broader market concerns.

Investors should monitor these movements closely, as they often indicate underlying trends that may not yet be apparent in the broader market.

Sector Performance: What to Watch

As central banks navigate economic challenges, certain sectors tend to outperform others. Utilities and real estate investment trusts (REITs) have shown resilience, often favored during uncertain times.

- Utilities: Stable demand amidst volatility

- REITs: Income generation through dividends

- Semiconductors: Key drivers of technology growth

- Gold: Safe-haven asset during market turmoil

Investors should consider diversifying their portfolios to include sectors that traditionally perform well during periods of economic instability.

Looking Ahead: The Future of Central Banks and Market Dynamics

The future of central banks remains uncertain as they grapple with inflationary pressures and potential recessions. Their ability to respond effectively to economic challenges will be crucial in shaping market dynamics in the coming months.

As traders and investors, staying informed about central bank policies and market trends is critical for making sound investment decisions. Monitoring economic indicators, earnings reports, and geopolitical developments will provide insights into potential market movements.

Preparing for Potential Market Shifts

In light of the current economic landscape, it is essential to prepare for potential market shifts. Here are some strategies to consider:

- Diversify your portfolio across sectors.

- Stay informed about central bank announcements.

- Monitor economic indicators closely.

- Be cautious with high-risk investments.

- Consider safe-haven assets during uncertainty.

By implementing these strategies, investors can better navigate the complexities of the market influenced by central banks.

Conclusion

Central banks are pivotal players in the financial markets, influencing everything from interest rates to investor sentiment. Understanding their role and the current economic landscape is essential for traders and investors looking to make informed decisions. As we move forward, staying abreast of central bank policies and market trends will be crucial in navigating potential volatility and capitalizing on opportunities.

Made with VideoToBlog