In the fast-paced world of SPX options trading, very few traders stand out for the right reasons. Consistency is rare. Discipline is rarer. And the ability to execute in real time while teaching others is almost nonexistent.

That’s exactly why CoolaDoola, known online as Optionscalps, has earned his reputation as one of the most respected SPX 0DTE scalpers in the game — and why he’s a co-owner of Rawstocks LLC.

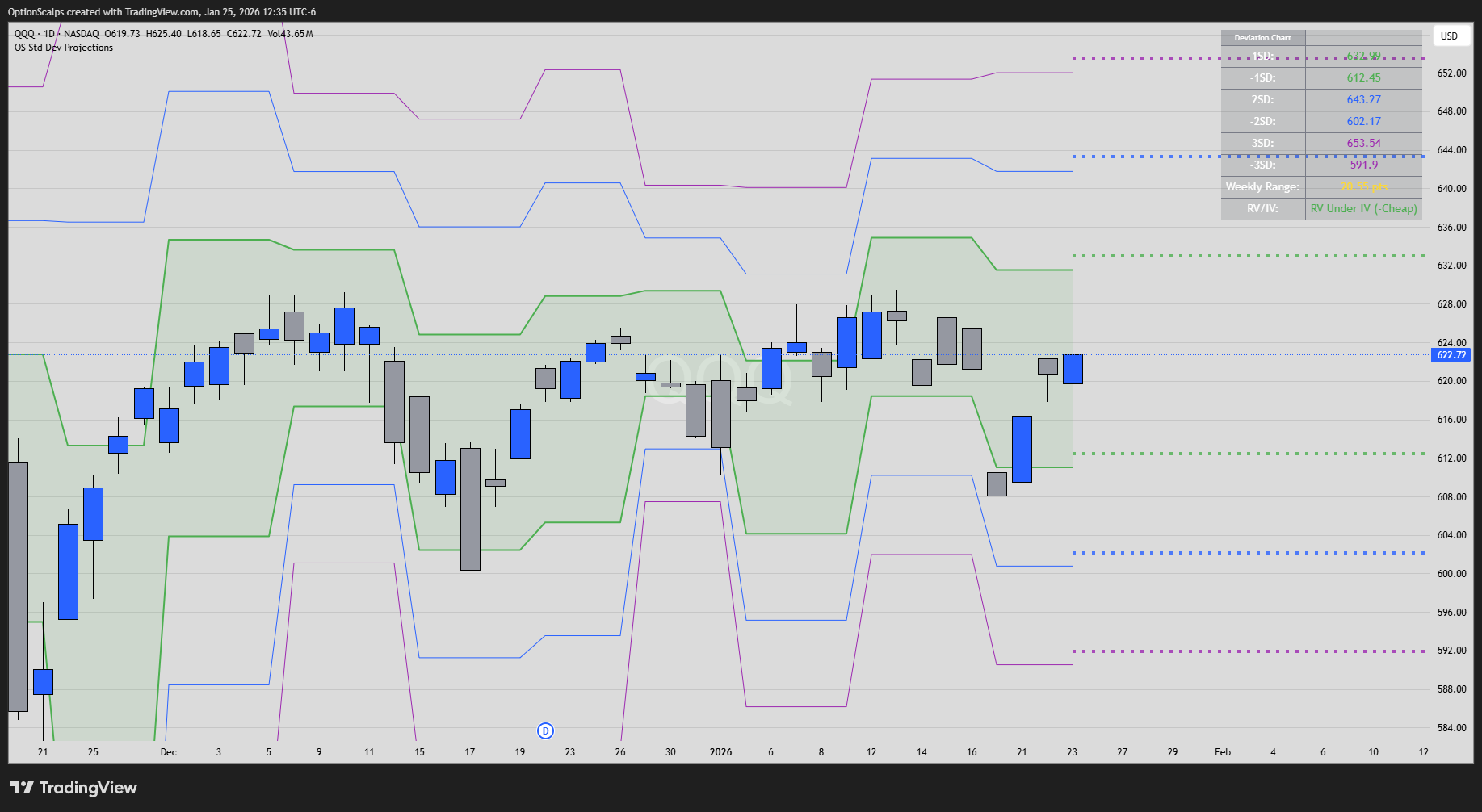

On his X account, @optionscalps, CoolaDoola delivers real-time market observations, intraday levels, and tactical commentary focused almost exclusively on the S&P 500 index (SPX) and its options. For traders who understand that seconds matter and structure is everything, his insights hit differently.

A Trader Built for the SPX

SPX is not a forgiving instrument.

There’s no overnight holding. No mercy for hesitation. And no room for sloppy risk management.

CoolaDoola thrives here because his trading style is built specifically for this environment. His edge comes from:

- Precise intraday level identification

- Understanding dealer behavior and volatility shifts

- Respect for risk, timing, and execution speed

Rather than chasing every move, he focuses on high-probability scalps, often around critical inflection points where liquidity, gamma, and price action converge.

This is not “guessing direction.”

It’s reacting to structure.

Tactical, Not Generic

Scroll through CoolaDoola’s X feed and you won’t find motivational fluff or hindsight charts. Instead, you’ll see:

- Morning SPX context before volatility expands

- Real-time updates as intraday conditions evolve

- Clear commentary on when not to trade

- Tactical awareness of squeezes, fades, and pinning behavior

His posts regularly highlight:

- Bullish or bearish tailwinds

- Critical support and resistance zones

- When implied volatility is likely to expand or compress

- Where SPX could stall, accelerate, or reverse

Everything is framed for active traders, not spectators.

Real-Time Alerts and Scalp-Focused Execution

CoolaDoola’s guidance extends beyond commentary. He actively shares live trading alerts and structured scalp ideas designed for traders operating on short timeframes.

These alerts are built for:

- SPX 0DTE traders

- High-frequency scalpers

- Traders who prioritize defined risk and fast exits

There’s no illusion of certainty — just clear plans, fast execution, and accountability. That transparency is exactly why traders trust his approach.

A Core Pillar of Rawstocks LLC

As a co-owner of Rawstocks, CoolaDoola plays a central role in shaping one of the most active and data-driven trading communities available today.

Rawstocks was built to eliminate guesswork by combining:

- Real-time options flow

- Gamma exposure analysis

- VWAP-anchored structure

- Proprietary trade plans and alerts

CoolaDoola’s SPX expertise directly feeds into this ecosystem, helping traders understand how institutional mechanics translate into intraday opportunity.

👉 Join the Rawstocks community here:

https://whop.com/rawstocks

Beyond the Screens: Why Traders Follow CoolaDoola

What truly separates CoolaDoola from most traders isn’t just performance — it’s communication.

He emphasizes:

- Discipline over dopamine

- Process over prediction

- Repeatability over hype

By sharing clear levels, actionable watchlists, and measured expectations, he helps traders sharpen their execution rather than chase randomness. That mindset has elevated countless members inside the Rawstocks community — especially those transitioning into SPX trading.

Stay Connected

If you trade SPX, scalp 0DTEs, or want to understand how professionals manage intraday risk, CoolaDoola is a must-follow.

- Follow CoolaDoola on X: @optionscalps

- Join Rawstocks for live alerts and structure:

https://whop.com/rawstocks - Watch breakdowns and education on YouTube:

https://youtube.com/@rawstocks

Want to see how Charm and Vanna are changing options trading?

👉 Read our full breakdown here: https://rawstocksllc.com/gamma-edges-new-web-app-update-why-charm-vanna-change-everything-for-options-traders/

Leave a Reply